What You Need To Know

Link To Omni

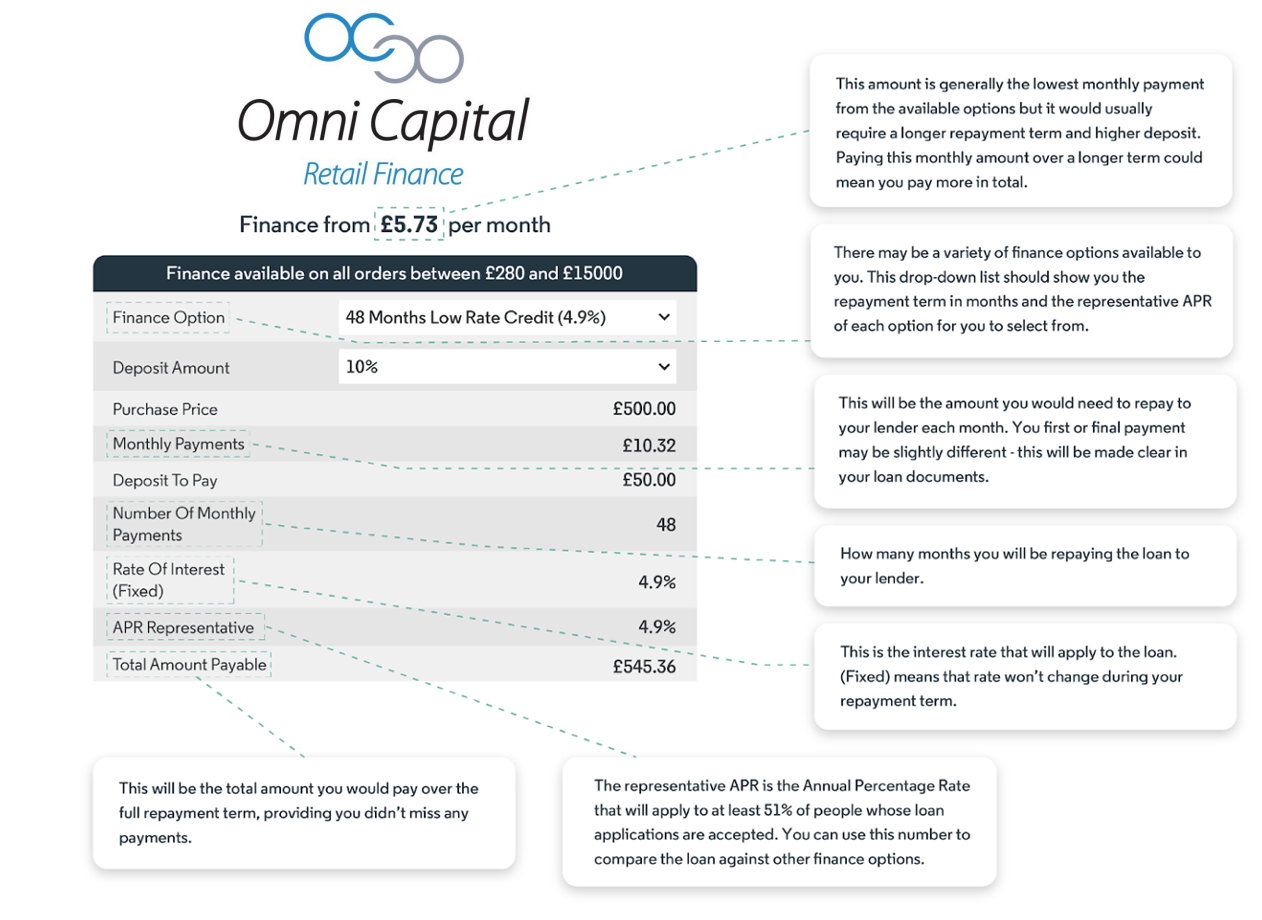

Omni, one of the UK’s leading finance specialists, so that you can apply for and complete a loan application quickly and easily - the online application process only takes a couple of minutes to complete, and you will receive confirmation of whether your application has been successful, or referred for further consideration, instantly.

To spread the cost of your purchase, simply choose Omni at the checkout and select the finance option that suits you. The application form is quick and simple and includes help text throughout to assist you. You will receive a decision from your lender in just a few seconds.

Please be aware that finance options are a form of credit. If you fail to maintain your payments, your lender could ask a debt collector to contact you or commence legal action to recover the money you owe. A poor repayment record will affect your credit file.